Entities that are active in several countries require an enterprise-wide, uniform accounting policy. However, they face considerable challenges because every country imposes its own unique accounting regulations. Moreover, some entities that operate at national level submit financial statements, either mandatorily or voluntarily, in compliance with international accounting standards as well as national standards. They face the question, what is the optimal approach? A “super set of books” that unifies the accounting principles of all countries? Or adjustment accounting that involves a common core for individual financial statements in all countries and only posts the differences for international GAAP? Or parallel accounting that generates entirely separate entries for national and international GAAP in each country? In this blog, an alternative fourth way will be proposed: Multi GAAP 2.0 or, playfully nicknamed, “Mickey Mouse Accounting”.

In financial accounting, it is common practice to post business events at individual deal level. This ensures that financial statements are transparent and absolutely comprehensible. Moreover, it allows for a 360° analysis of the entire portfolio and lays the foundation for detailed reporting requirements such as FINREP.

However, accounting at individual deal level still does not answer the question, as to how an entity, which needs to accommodate for multiple accounting regulations because of its international commitments and/or business connections, can integrate such regulations into its financial accounting system.

Whereas only internationally active enterprises had to comply with multiple local, country-specific accounting standards in the past, nowadays entities that operate in only one country have to adhere to both national and international regulations.

In both cases, entities usually have a local set of books (e.g. UK GAAP or German HGB) and add adjustment entries for the purpose of additional GAAPs such as IFRS or US GAAP.

In the context of Adjustment Accounting, it is assumed that the local set of books is optimised and straightforward. If this prerequisite is not met, any incorrect entries unavoidably impact IFRS accounting, only increasing complexity. Obviously, transparency and traceability plummet as complexity rises. Simultaneously, process interdependence, which is not conducive to a “fast closure” or effective support for corporate management, is created.

The procedure becomes more difficult if valuations and valuation dates vary between accounting systems and such discrepancies have to be represented by incremental adjustment entries. For example, different requirements relating to the timing and measurement of risk provisions or varying interpretations of the “effectiveness” of economic hedges from a regulatory perspective may lead to such a situation.

Even for an apparently simple issue, such as the time when a charge is recognised – e.g. amortisation according to the effective interest rate method or linear distribution – problems of transparency and complexity emerge. This is because the effective interest rate method under IFRS 9 requires specific cost components to be amortised over the interest period and others over the life of the deal. This illustrates that even the seemingly simple distribution of a charge over time can bring about substantial challenges for the preparation of financial statements due to the specific regulations in each case.

These issues are currently often circumvented via assumptions and simplifications, but are rarely truly solved. Consequently, the methods applied are difficult to reconcile with the accounting guidelines and as such their acceptance by auditors and expected lifespan are limited.

Parallel accounting, as an alternative, solves these practical problems by separately posting business events in each GAAP, hence multiple times in parallel. Nevertheless this introduces new problems, as redundant journal entries bloat the overall accounting system. Notably cancellations and subsequent adjustments become time-consuming and thus costly, if this parallel approach is applied.

The approach that involves merging all accounting rules in one comprehensive set of books is also difficult. The goal of this method is to jointly cover all financial reporting requirements for all GAAPs, which apply to an enterprise, in one global accounting system. This leads to a very granular chart of accounts structure („fat ledger approach“). Nevertheless, just like adjustment accounting, this approach will fail as soon as business events need to be recognised at different points in time in the various accounting standards that need to be complied with.

The “super set of books” may be a viable solution for such plain vanilla instruments, the accounting of which does not require risk provisioning, for hedging relations that are not governed by regulatory regulations or where different amortisation methods are irrelevant. In all other cases, the “super set of books” is blurry, demanding and fragile. As such, this approach can be a short-term quick fix which will, however, not stand the test of time.

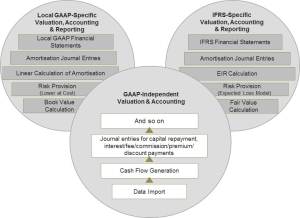

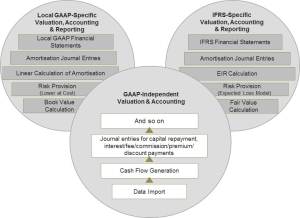

Multi GAAP 2.0 was designed to counterbalance the flaws of the above-mentioned methods. The basic idea is the segregation between GAAP-identical and GAAP-unique business events. In a central “basic” set of books, all GAAP-identical valuation components are exclusively posted in an event-based way. This builds the head of the mouse. The two ears of Mickey Mouse are then added metaphorically. One is the national GAAP, in which all GAAP-unique valuation components are calculated and posted in compliance with local regulations. The second ear depicts a separate set of books for every international GAAP applicable to the entity, in which all GAAP-unique valuation components are calculated and booked in compliance with international regulations – e.g. IFRS. If more accounting standards are required, they can be added as independent sets of books.

Below is a graphical representation of mouse accounting, which illustrates the merger of all sets of books.

The views for the balance sheet and the profit and loss account for each local and international accounting standard then consist of the basic set of books and the respective local or international set of books, for which the balance sheet, the profit and loss account or the financial report needs to be produced.

This method ensures that GAAP-identical events are consistently valued and posted only once. The generation of transaction-based, event-driven journal entries assures drilldown to individual deal level, its business events and valuation details for all GAAP-identical and GAAP-unique valuation elements in every single GAAP.

The end user does not observe that GAAP-identical valuation components are only “virtually” added to the basic accounting set of books.

In Multi GAAP 2.0, the end user is not aware of the adjustment: GAAP-specific balance sheets and profit and loss accounts consist at technical level of the basic set of books and another set of books that is based on specific regulations. Both are unified for the purpose of presentation and evaluation. Hence, at no time does an accounting standard depend on another standard, but rather it is complete in itself and can be traced for business events, single deals and the underlying valuation methods. If the set of books for GAAP-identical events requires a chart of accounts that is different from the basic set of books, it is possible to prepare the balance sheet and profit and loss statement via simple mapping at individual deal level.

Multi GAAP 2.0 can be used universally for simple and complex, small and large portfolios. As such, it constitutes the optimal solution for enterprises that operate at national and international level.

Author: Dr. Karl Kirchgesser, Director, Executive Vice President at FERNBACH